Age Twenty: Only Sometimes, Word Storm

257. Organisation of African States

The Organisation of African Unity, also known as the Organisation of African States, was founded in 1963 as an international political body to promote cooperation between African nations. This came in response to the “Year of Africa” in 1960, during which seventeen countries gained their independence, and colonial control by Europeans came to an end across much of the continent. In response, a movement called Pan-Africanism sought to replace colonial or tribal identity with a shared African identity—much like the shared European identity that the European Union now promotes.

One of the leaders of Pan-Africanism was the president of Ghana, Kwame Nkruma. According to Nkruma, in order to have an influential role in the world, Africans from all nations would have to work together. And to overcome the serious poverty facing many African countries, he said they would need to develop their own science and technology. Ultimately, Nkruma hoped that Africa’s countries would join into a federation called the United States of Africa. Until then, the Organization of African States aimed to promote peace among its members and rising quality of life for all Africans.

The organization was initially led by Emperor Haile Selassie of Ethiopia, and leadership rotated among the heads of state of member countries. Early on, it was renamed the Organisation for African Unity (OAU) to emphasize its goal. Although the OAU was helpful in resolving some conflicts among its members, such as a series of disputes between Somalia and its neighbors Ethiopia and Kenya, it did not bring about the hoped-for African unity. Civil wars and genocide still occurred in Africa, and without a military component to enforce its decisions, the OAU was unable to stop violence and conflict.

On September 9, 1999, the OAU voted to become the African Union, and this change came into effect in 2002. The African Union differs from the OAU in several important ways. First, it places more emphasis on human rights and peacekeeping. Unlike the OAU, the African Union has a joint military force made of soldiers from the member countries. This force has been deployed to help keep the peace in Africa, such as its ongoing operations in Somalia since 2007 to suppress Islamic jihadist groups. Additionally, the African Union emphasizes that it is an organization of African peoples rather than individual leaders or governments. It seeks to promote democracy throughout the continent, and provides support to anticorruption efforts. At present, the African Union has 55 members, including all widely recognized nations in Africa and covering virtually the entire African landmass.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, as president of the United States, twenty-year-old Danielle gets a visit from her old Zambian friend Amukusana “Amu” Mwanza, who has become president of the Organisation of African States (African Union). Danielle gives Amu a medal that President William Henry Harrison had once given to Alexander Ross for writing the song that helped Harrison get elected. Then, Danielle and Amu have a pillow fight with pillows that had been given to George Washington by King Louis XVI of France.

See entries for Sunni terrorist groups, Jihad, President Harrison, Alexander Ross, and King Louis XVI of France.

How You Can Be a Danielle and help the people in developing nations.

258. Tippecanoe and Tyler Too

When William Henry Harrison was running for US president in 1840, his running mate was John Tyler. Earlier in his career, Harrison had been governor of the Indiana Territory. While serving in this office in 1811, he led American forces in battle against the Native American chief Tecumseh at the battle of Tippecanoe in what is now Indiana. The battle was a major United States victory, and Harrison got the nickname “Tippecanoe” from the site of the battle. As a presidential candidate almost three decades later, his campaign song as the Whig party nominee was called “Tippecanoe and Tyler Too.”

The song’s lyrics were written by Alexander Ross and set to the melody of an old song called “Little Pigs.” The song glorifies Harrison and Tyler, and insults their opponent President Martin Van Buren as “Little Van.” The song became a gigantic hit, and was said to have “sung Harrison into the Presidency.”

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when Danielle is US president, she has a reunion with her best friend Amukusana Mwanza, a Zambian girl she met on her visit to that country as a child, and quickly befriended. Now, Amukusana is president of the Organization of African States. They greet each other warmly, and Danielle sings “Tippecanoe and Tyler Too,” as she puts a medal around Amukusana’s neck. Danielle explains that President Harrison had given that medal to Alexander Ross for writing the song that helped him win the 1840 election. Amukusana comments that Danielle sang herself into the White House, too.

See entries for Zambia, Zambian drought, Sempala, Organisation of African States, President Harrison, and Alexander Ross.

259. President Harrison

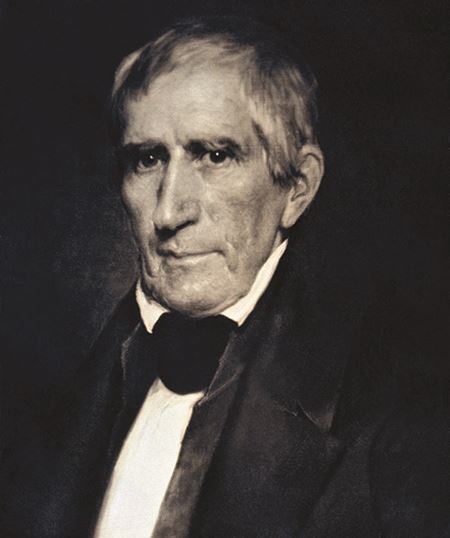

William Henry Harrison, 9th President of the United States

William Henry Harrison (1773–1841) was the 9th president of the United States. He is most famous as the president who served the shortest time in office, because he delivered a very long inaugural address in cold weather, got pneumonia, and died exactly one month later. As a result, he has no significant legacy from his time in the White House.

During his earlier career, Harrison had served as governor of the Indiana Territory from 1801 to 1812. During this time, he led US soldiers in the 1811 battle of Tippecanoe, fighting against the Native American chief Tecumseh. The battle was a big victory for the United States forces, which led to Harrison being nicknamed “Tippecanoe.”

Almost thirty years later, while running for president in the election of 1840, Harrison emphasized his image as a brave military leader. Alexander Coffman Ross wrote a song titled “Tippecanoe and Tyler Too” in support of Harrison and his running mate John Tyler. The song became wildly popular, and is credited as having “sung Harrison into the Presidency.”

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when she is US president herself, Danielle has a reunion with her old Zambian friend “Amu” Mwanza, who has become president of the Organization of African States. Danielle sings “Tippecanoe and Tyler Too,” and gives Amu a medal that President Harrison had given Alexander Ross in recognition for writing that song. Amu replies that Danielle sang herself into the White House, too.

See entries for Zambia, Organisation of African States, Tippecanoe and Tyler Too, and Alexander Ross.

260. Alexander Ross

Alexander Coffman Ross (1786–1864) was the songwriter of “Tippecanoe and Tyler Too,” the campaign song of William Henry Harrison and John Tyler in the 1840 US presidential election. He was a soldier during the War of 1812, and served as a gunsmith for the American army. He went on to become a watchmaker and jeweler in Zanesville, Ohio. He was also a pioneer of the new Daguerre process—a revolutionary new technology for creating photographs.

When Ross wrote “Tippecanoe and Tyler Too,” he set it to a familiar melody called “Little Pigs.” Tippecanoe refers to the nickname that Harrison got after leading American forces in a major successful battle against Native American chief Tecumseh at the battle of Tippecanoe.

The song caught on and soon became immensely popular. It helped Harrison win the election, and is even credited as having “sung Harrison into the Presidency.” Unfortunately, Harrison became ill following his inauguration speech, and died after only one month in office.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when Danielle is US president, at age nineteen, she meets with her old friend Amukusana Mwanza, who is now president of the Organisation of African States. Danielle gives “Amu” a medal that Harrison had given Ross in recognition for writing the song that helped him get elected.

See entries for Tippecanoe and Tyler Too, President Harrison, and Organisation of African States.

261. King Louis XVI of France

Louis XVI (1754–1793) was the final King of France before the monarchy was abolished during the French Revolution. He came to the throne as a young man in 1774, succeeding his grandfather Louis XV. During his reign, there was increasing unrest among the people, and Louis XVI was unable to defuse the growing crisis. Along with his wife Marie-Antoinette, he was arrested by revolutionaries and beheaded in 1793.

When Louis XVI was born, France was the most powerful nation in Europe. His great-great-great grandfather, Louis XIV (known as the Sun King) had created great prosperity and stability during his seventy-two-year reign. But Louis XV did not have the genius or energy of his predecessor. Instead, he spent money lavishly and surrounded himself with corrupt courtiers. The common people had to work very hard to support the luxurious lifestyle of the elites, and their resentment grew. By the time Louis XVI came to the throne, the seeds of revolution had already been planted.

A positive step taken by King Louis XVI was the Edict of Versailles. This order, signed in 1787, gave Protestants and Jews full civil rights. Protestants had been persecuted in France for more than two centuries before that, and French Jews had been persecuted since the Middle Ages. Some Catholics were unhappy with the edict, but it allowed many people of different faiths to participate more fully in French society.

Probably the most significant achievement of Louis XVI is that he gave French support to the American revolutionaries during the war for independence from the British. By sending ships and soldiers to America, he turned the tide in favor of the new nation. Without French help, it is unlikely that the United States could have survived. Yet the debt France took on to pay for its involvement in the war required even higher taxes, and the people became more unhappy with the government. They read reports from across the Atlantic about how the United States had established a new, republican form of government that rejected monarchy and the idea of rule by kings. Envious of American freedoms, they turned against King Louis.

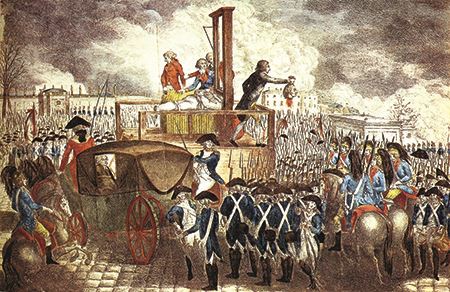

King Louis XVI of France, reigned 1774 to 1792

In 1789, the King convened the Estates-General, essentially France’s ceremonial parliament, to discuss these problems. The members representing the commoners, called the Third Estate, demanded a constitution limiting Louis XVI’s power. They gathered on an indoor tennis court near the palace of Versailles and swore what became known as the Tennis Court Oath, vowing to each other that they would stay together until the monarchy made important reforms. While the Estates General were meeting, on July 14 a mob stormed the Bastille, a Paris prison that had become an infamous symbol of the regime’s brutality. Unrest spread across France.

Painting of the Tennis Court Oath by Jacques-Louis David

Soon after, the Third Estate representatives, calling themselves the National Assembly, published the Declaration of the Rights of Man and of the Citizen. This document was directly inspired by the American Revolution, and expressed the liberal philosophical ideas of the Enlightenment. For a while, it seemed that Louis XVI would accept a reduced role as the head of a constitutional monarchy like that in Great Britain. He moved from the magnificent palaces of Versailles to smaller accommodations in Paris, and agreed to many of the people’s demands.

Yet King Louis still hoped to reverse the events of the revolution. In 1791, he hatched a plan to escape Paris for the fortress city of Varennes in the east of France. There, he would gather loyal troops with the assistance of several foreign countries, and suppress the revolution. But King Louis was caught as he left Paris in disguise, and the revolutionaries became even more hostile to him. Instead of calling for a constitutional monarchy as they had before, many now called for a republic—and for the monarchy to be totally abolished.

The beheading of King Louis XVI at the Place de la Révolution (Concorde) in Paris

On September 21, 1792, a new revolutionary assembly called the National Convention formally ended the monarchy. An armed crowd attacked Louis XVI’s palace and arrested him. He was charged with treason, under the name Citizen Louis Capet, which is a reference to the name of the medieval founder of the French royal dynasty, Hugh Capet. Found guilty, King Louis XVI was sentenced to death and beheaded by guillotine at the Place de la Révolution (Concorde) in Paris on January 21, 1793.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when Danielle gets into a pillow fight with her Zambian friend Amu, they use eighteenth century French pillows that had been presented to George Washington as a gift from Louis XVI of France.

See entry for French Revolution.

262. Secret Service

The US Secret Service is the government agency with primary responsibility for protecting the president of the United States, their family, and other top officials. This involves a combination of uniformed officers who provide security for facilities such as the White House, and plainclothes officers who provide “close protection” for American leaders and foreign dignitaries when they are in public.

The first president to be assassinated, Abraham Lincoln, was killed just a few months before the Secret Service was established. During the Civil War, Lincoln had been protected by a mixture of private detectives, police, and soldiers. But these people did not have specialized training in how to prevent or thwart assassination attempts. Instead, they learned “on the job.” Major mistakes allowed John Wilkes Booth to gain access to the theater box where Lincoln was watching a play and fatally shoot him. If Lincoln had had bodyguards who were more professional, the killing probably could have been prevented.

At first, though, the Secret Service was not used for presidential protection. Instead, because it was a part of the Treasury Department, it was used to combat money counterfeiting, which was a big problem just after the Civil War. Secret Service agents tracked down counterfeiters, smugglers, and fraudsters, and brought them to justice. This was an important mission because at that time there were very few federal law enforcement agencies, and financial crimes often spanned multiple states and made it difficult for state-level investigators to stop them.

After two more presidential assassinations—of James Garfield in 1881 and William McKinley in 1901—Congress finally placed the Secret Service in charge of protecting President Theodore Roosevelt. By the 1930s, many of the other crime-fighting functions of the Secret Service were transferred to the Federal Bureau of Investigation (FBI), and presidential protection became the main focus of the agency.

The Secret Service’s greatest failure came on November 22, 1963, when President John F. Kennedy was assassinated in Dallas, Texas. There were many investigations into the incident, and it became clear that security precautions had been lax. For example, the limousine Kennedy was riding in had an open top and was driving slowly, making it easier for a sniper to shoot him. In response to this tragedy, the Secret Service made major revisions to its policies to make it much harder for something like that to happen again.

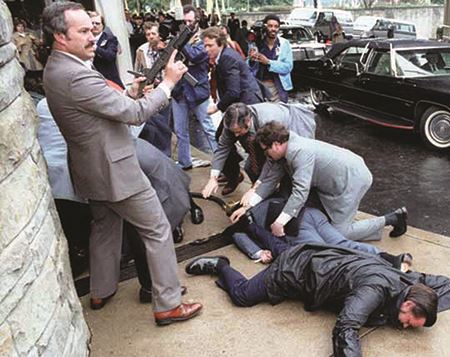

With the sad exception of President Kennedy, the Secret Service has had success in its mission. It has thwarted numerous attempts to harm US presidents and other officials. An agent was killed protecting Harry Truman in 1950, and another was wounded protecting Ronald Reagan in 1981. The Secret Service prevents other attacks from happening in the first place, by making it harder for would-be assassins to get an opportunity. Agents follow up on thousands of leads a year about possible dangers. When people make threats to kill the president, or citizens report suspicions about someone who may be plotting an assassination, the Secret Service investigates to determine whether the threat is credible, and to take appropriate action.

Chaos outside the Washington Hilton Hotel after the assassination attempt on President Reagan by John Hinckley, Jr. James Brady and police officer Thomas Delahanty lie wounded on the ground (1981)

In 2003, the Secret Service was transferred from the Department of the Treasury to the Department of Homeland Security to promote better information sharing with other security agencies. Still, the Secret Service does continue a limited portion of its old role in investigating some financial crimes.

The most famous unit of the Secret Service is the Presidential Protective Division (PPD). The PPD is responsible for the closest layer of security around the president, and making sure that they can move safely from place to place. To accomplish this mission, the PPD gets highly specialized training, as well as using state-of-the-art technology. For example, the current generation of presidential limousine is known as “the Beast.” This is a custom-built Cadillac with eight-inch-thick doors, five-inch-thick windows and enough armor to stop even attacks by explosives and heavy weapons. Similarly, the official presidential airplane, known as Air Force One, is a modified Boeing 747 with special defensive devices and secret technologies to help the president communicate with their advisors around the world during an emergency.

The presidential limousine, a custom-built Cadillac nicknamed “the Beast”

The PPD is divided into the Close Protection Team and the Counter Assault Team, which are designed to work together in an emergency. If an assassination attempt occurs, the Close Protection Team is in charge of getting the president out of immediate danger and to a place of safety. This may include deploying special briefcases or umbrellas that turn into bulletproof shields, or even covering the president with their own bodies. If possible, they then move the president to the Beast, which drives to safety at high speed. Meanwhile, it is the job of the Counter Assault Team to attack the assassin or assassins themselves and divert their attention away from the president. Unlike the Close Protection Team, which usually wears dark business suits, the Counter Assault Team typically accompanies the president wearing full body armor and carrying assault rifles.

United States President Barack Obama with Senator Sherrod Brown, Representative Mary Jo Kilroy, and Secret Service personnel arriving at Port Columbus International Airport in Columbus, Ohio.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, Danielle brings indie musician Michael Matthews as her date to the Grammys, they go to a small restaurant afterward. Because she is president of China and therefore a foreign dignitary, the Secret Service is responsible for protecting her on American soil. After the date, Michael and Danielle are escorted home at about 3:00 am by a mixed group of Chinese security forces and Secret Service. Years later, when Danielle has a meeting in the White House with her old friend Amu from Zambia, they get into a pillow fight. Claire notices that Jeremy, one of Danielle’s Secret Service agents, takes his job very seriously and is alarmed by even this playful attack on President Danielle.

See entries for President Obama, President Reagan, Indie music, Zambia, and Organisation of African States.

263. Oval Office

The official office of the president of the United States is a large oval-shaped room in the White House known as the Oval Office. For most of American history, the president conducted his business from one of several offices within the main White House residence. But as presidential staffs became larger, the need increased for a separate office space. At the beginning of the twentieth century, President Theodore Roosevelt had a new wing built onto the White House, known as the West Wing. His successor William Howard Taft built the first Oval Office and made it the center of his government. In the 1930s, Theodore Roosevelt’s cousin Franklin Delano Roosevelt rebuilt much of the West Wing following a fire, and had the modern Oval Office constructed.

President Richard Nixon meets rock’n’roll legend Elvis Presley in the Oval Office on December 21, 1970

Since then, the Oval Office has become the setting for many momentous and iconic moments in American history. Presidents traditionally deliver televised addresses to the nation from the Oval Office at moments of great tragedy, such as Ronald Reagan after the explosion of the space shuttle Challenger in 1986, and George W. Bush after the September 11 terrorist attacks in 2001. Presidents also use addresses from the Oval Office to inform Americans about war and peace, such as John F. Kennedy’s 1962 speech about the Cuban Missile Crisis, and George H.W. Bush’s remarks about the beginning and end of the Persian Gulf War. Additionally, some presidents choose to make a farewell address from the Oval Office, such as Richard Nixon announcing his resignation in 1974, and Bill Clinton at the end of his second term in 2001.

President John F. Kennedy’s two young children Caroline and John Jr. play in the Oval Office, with the Resolute desk in the background

The Oval Office has also been the location of some of the most enduring photographs of the American presidency, such as John F. Kennedy’s young son John Jr. playing inside the famous Resolute desk. This desk was made from the timbers of the British sailing ship Resolute and presented as a gift to the United States by Queen Victoria. The desk is now considered the symbolic center of the presidency itself, and presidents often sign important documents on it.

Each new president modifies the other furnishings in the Oval Office to reflect their personal tastes. For example, they may change the rug or the color of the draperies. Recent presidents have hung paintings of predecessors they admire, and busts of Martin Luther King, Jr. and Winston Churchill have been displayed in positions of honor.

President Barack Obama meets with his chief of staff, Rahm Emanuel, in the Oval Office

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when Danielle is president of the United States at age nineteen, she meets her old Zambian friend Amukusana “Amu” Mwanza, who has become president of the Organisation of African States. Amu was Danielle’s first friend whom she met in Zambia when she was six years old. They retreat to the Oval Office for a private conversation about Africa and a pillow fight.

See entries for Zambia, Organisation of African States, President Obama, and President Reagan.

264. Capital gains taxes

Capital gains taxes are taxes on earnings people make from selling assets, as opposed to doing ordinary work. Assets include most valuable items other than merchandise that someone sells as part of their business. These include items such as stocks, bonds, real estate, gold, and collectible art. When a person sells these assets for more than they originally paid for them, this profit is considered a capital gain. Although tax laws differ from country to country, capital gains taxes are typically defined as a certain percentage of someone’s net capital gains in a given year. This means that if someone sells some assets for less money than they paid for them, these losses can offset profits from other sales and reduce the amount of tax that must be paid.

In some countries, the government distinguishes between short-term capital gains and long-term capital gains. Short-term gains are from assets owned for a short period, typically less than a year. For example, if someone buys stock in a technology company and sells it a month later at a 10 percent profit, this is a short-term gain. These gains may be taxed at a higher rate, because they are seen as having a function much like ordinary income. Someone who spends their time trading short-term assets probably does so frequently. By contrast, gains from assets held for a long time are often from events that might only happen a few times in a person’s life, like selling a home or cashing in a retirement fund. Because these long-term investments promote stability, governments often tax them at a lower rate to encourage that behavior.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, during her second year as president of the United States, Danielle proposes a radical tax simplification plan. She advocates low tax rates, but in a system with no exceptions or loopholes. This is because loopholes are like a tax reduction for the people who can afford to hire expensive lawyers and accountants specifically to find loopholes. This unfairly burdens people who cannot afford those services. It also encourages economic decisions that are not optimal and causes people to waste time on optimizing taxes which does not contribute to the economy. Danielle argues that a system with low tax rates and virtually no exceptions or deductions is the best solution given how complex the economy is. She notes that raising capital gains taxes would cause wealthy investors to make fewer stock trades, leaving them with their money stuck in unproductive businesses, and making it harder for innovative businesses to get investment.

See entries for Tax simplification, Long-term capital gains, Simple preferred stock, Bond offer, Incentive stock options, and Black-Scholes value.

How You Can Be a Danielle and start your own company.

265. Tax simplification

In most developed countries, the rules for how much people and companies should pay in taxes are very complex. These rules are published in laws known as tax codes, which usually specify that different kinds of income are taxed at different percentages. Determining a person or a company’s taxable income is the most complicated aspect as it involves intricate calculations of deductions and other considerations. Simplification refers to reforms intended to make the tax code easier to understand. The goals are to enable ordinary people to understand the rules, to spend less time calculating tax payments, to prevent extensive efforts to manipulate the tax code, and hopefully to be fairer to everyone.

Economists say that taxes can have one of three effects with regard to a person’s income. “Progressive taxes” are those that take a higher percentage of the income of people who earn a lot of money than from those who earn little money (the tax rate “progresses” upward as you make more income). Most countries’ income taxes work by this principle.

The ethical justification for progressive taxes is that people need a certain small amount of income to pay for the basic essentials of living. So if you earn $10,000 in a year, a lot of that will be spent on food. But if you earn $1,000,000, much of that money will probably be spent on things that you want but don’t need. So when the government needs another dollar, it can better justify taking it from the millionaire than from the poor person.

The next kind of taxes is “flat taxes.” With flat taxes, everyone pays the same percentage, regardless of how much money they make. If a tax code says that everyone pays thirteen percent of all their income, that is a flat tax. Flat income taxes are relatively rare, but are used in much of Eastern Europe, including Russia, Estonia, and Bulgaria. A common ethical justification given for flat taxes is that they ask everyone to contribute an equal proportion of their income to government, so people may be less likely to feel that some citizens aren’t paying their fair share.

Finally, “regressive taxes” are taxes that amount to a higher percentage of someone’s total income if they are poor than if they are rich. Let’s say there is a sales tax of seven percent, meaning that whenever someone buys something in a store, seven percent of the purchase price is added on as an additional tax. Even though this percentage is flat for all customers, sales taxes are usually regressive because poor people usually spend a lot of their money buying basic necessities in stores. By contrast, wealthy people can afford to save and invest a lot of their money, and thus avoid the tax.

In practice, countries like the United States have a combination of all three kinds of taxes. In fact, in the United States there are hundreds of different taxes and fees paid to the government. They don’t all apply to everyone, but it is often unclear to the average person which taxes they owe, and how to calculate how much money they need to pay for each. The core of the US tax code is about 2,000 pages long, and including references and explanations it comes to almost four million words (four times the length of the Bible!).

The problem is that figuring out all the allowable deductions is complicated and time consuming. It requires background knowledge about tax law, and the time and ability to read through thousands of pages of information and understand what it all means. Most people can’t do that, so they wind up paying more taxes than the law actually requires. On the other hand, wealthy people and corporations can afford to hire specialist accountants and tax advisors to do their taxes for them. These experts can not only find all the deductions that their clients are allowed to make, but also recommend investments that allow them to avoid paying taxes. For example, Forbes estimated that in 2011, about 1,600 people with incomes over $1 million paid no income tax.

Over the years, many people have proposed simplifying the US tax code so it is less time consuming and fairer for everyone. A major step in that direction would be eliminating deductions that are the result of the lobbying efforts of a great variety of special interests over many years.

Already, new technology is having an impact on the tax system, though. Websites like TurboTax use artificial intelligence to do work that human accountants used to do, resulting in average citizens obtaining more of the deductions they are entitled to.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when Danielle is president of the United States at age nineteen, she develops an advanced economic model for understanding the effects of the tax system. Based on this, she proposes a radical tax simplification plan. She says: “I want to see all the tax planners doing something productive.” Similarly, she wants the thousands of employees of the Internal Revenue Service to do something more productive than managing and enforcing the unwieldy tax code. Danielle proposes reforms that lower tax rates, but removes almost all exceptions and loopholes. Danielle also adds a “negative income tax” which actually gives workers a payment from the government equal to 20 percent of the first $20,000 they earn in a year. She includes incentives for entrepreneurship, which stimulate innovation and risk-taking on new ideas. These policies are a great success, and by the middle of Danielle’s term, the US economy is growing at an outstanding 6 percent per year.

See entries for Negative income tax, Gross domestic product, Capital gains taxes, and Long-term capital gains.

266. Negative income tax

A negative income tax (NIT) is a proposed system where people who make below a certain annual income actually receive money from the government when they file their taxes. Negative income taxes have not been widely implemented yet, but there is growing support around the world for NITs to be introduced.

The basic premise is that income taxes are usually progressive, meaning that as someone’s earnings increase, they owe a higher percentage of their income in taxes. If someone makes very little money, they owe a small percentage. If their earnings fall below a certain threshold, they owe no tax at all. Negative income taxes take this a step further, actually giving people money based on how far they fall below that threshold. Unlike the concept of “universal basic income,” negative income tax is a percentage of the money that person earns, so if a person does not earn any money they do not get any negative income tax paid to them.

A negative income tax helps people with lower income, but provides an incentive to work. Basically it is a government subsidy for lower paying jobs.

For the last several decades, the United States has had a program similar to a classic NIT called the earned income tax credit (EITC). The EITC allows low-income people, especially if they have children, to deduct a certain percentage of their earned income from the amount they owe in income taxes. Since those with low income usually pay very little tax anyway, this often results in a negative number—which is the size of the check the government pays out as a benefit.

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, when Danielle is president of the United States at age nineteen, she introduces a negative income tax based on a simplified EITC. Danielle’s plan pays citizens 20 percent of their first $20,000 of income. So someone earning $15,000 would get a benefit check for $3,000. This helps get the support of liberals for some of Danielle’s other economic reforms, including lower tax rates. She also passes a radical tax simplification plan and creates incentives for entrepreneurship. Together, these policies, along with confidence in Danielle’s leadership, give the country a big economic boost, and by the middle of Danielle’s term, GDP growth reaches 6 percent per year.

See entries for Tax simplification, Gross domestic product, Capital gains taxes, and Long-term capital gains.

267. Gross domestic product

Gross domestic product (GDP) is a measure of the total value of goods and services produced in a country. It represents the total value added, so that parts that go into a final product are not double counted.

GDP is the most common measure of the size of a nation’s economy while per capita (per person) GDP is a measure of the prosperity of a nation’s individuals. India’s GDP is about $2.1 trillion compared to Norway’s $525 billion, but since Norway’s population is much lower, its per capita GDP is about 50 times greater than India (about $100,000 compared to $1,900).

What GDP does not measure is the dramatically increasing value to users of information products. For example, the production of a $300 smartphone in 2016 counts as only $300 of contribution to GDP despite the fact that it represents billions of dollars of computation and communication circa 1970. As another example, the production and sale of an encyclopedia for $1,000 in 1980 counted then as $1,000 of contribution to GDP, whereas the availability of a far superior encyclopedia in the form of Wikipedia in 2016 does not contribute to GDP at all because it is free.

According to my “law of accelerating returns,” information technologies (such as computation, communication, genetic sequencing, and many others) have a deflation rate of about 50 percent per year (depending on the technology), which means that prices come down (for the same capability) by about 99.9 percent in a decade. The point is often made that this phenomenon only applies to electronics and related information services but that you cannot wear, eat, or live in information products. One of the predictions made in my technology books is that we will indeed be able to do those things in the 2020s with the advent of effective three-dimensional printing (to print out clothing, modules to snap together houses, and many other physical items we need) and “vertical agriculture” (in which we will inexpensively produce high quality food without chemicals in AI controlled factories using hydroponic plants for fruits and vegetables, and in vitro cloning of animal muscle tissue for meat).

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, during Danielle’s first term as US president at age nineteen, she applies policies which accelerate the adoption of these advanced information technologies enabling a GDP growth rate of six percent per year, which for the US is considered very good. Again, that GDP growth rate does not take into consideration the increasing ability of a dollar to purchase such items as clothing, food, and housing.

See entry for Vertical agriculture.

268. Starting is the hardest thing

“Starting is the Hardest Thing” is a poem by Joe Willig, written for a poetry class I took with him at MIT in 1968 taught by the poet Barry Spacks (1931–2014).

The poem starts:

|

Starting is the hardest thing Only sometimes word storm Like a March flood Hurls a kayak Down the Allagash |

![]()

In the alternative reality of Danielle: Chronicles of a Superheroine, Danielle and Liu learn this poem together and recite parts of it back to each other to break the ice when Danielle visits the Chinese embassy in Washington, DC.